- Roko's Basilisk

- Posts

- Nvidia’s $5T Warning Sign

Nvidia’s $5T Warning Sign

Plus: Bezos cashes in, Ghibli fights back, AI ghost-chasing at Microsoft.

Here’s what’s on our plate today:

🧠 Inside Nvidia’s $5T rise and looming risks.

💸 Bezos bags $10B, Japan pushes back, Microsoft dismisses AI consciousness.

💡Before you scale, ask: Is this durable?

📊 Does Nvidia’s valuation reflect real AI value?

Let’s dive in. No floaties needed…

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

*This is sponsored content

The Laboratory

Inside Nvidia’s $5 trillion ascent

Since the rise of business economies, companies have dominated their respective markets. In the 1990s, when personal computers were gaining popularity, Microsoft became the default operating system for most PCs worldwide.

Similarly, in the 2000s, Intel dominated the CPU. Its Intel Inside campaign made it synonymous with computing power, and it controlled over 80% of the global market for desktop and laptop processors. Apple, similarly, dominated the smartphone market, not with sales figures, but with industry profits.

Even today, when considering smartphone chips, Qualcomm presents itself as a dominant player with its massive patent portfolio. Most phone manufacturers, other than Apple, license Qualcomm’s technologies to build 3G and 4G devices, much as AI startups now rely on Nvidia’s GPUs and software stack.

However, despite being the default OS, the company with the most patents related to telecommunications or humongous profits, none of these companies were able to achieve what Nvidia just did.

The chipmaker, which until recently was known predominantly for its graphics cards, which made animations look cool, is now worth more than most nations. In fact, its market valuation is now second only to the GDPs of China and the U.S.A., making it the most valuable company on the planet.

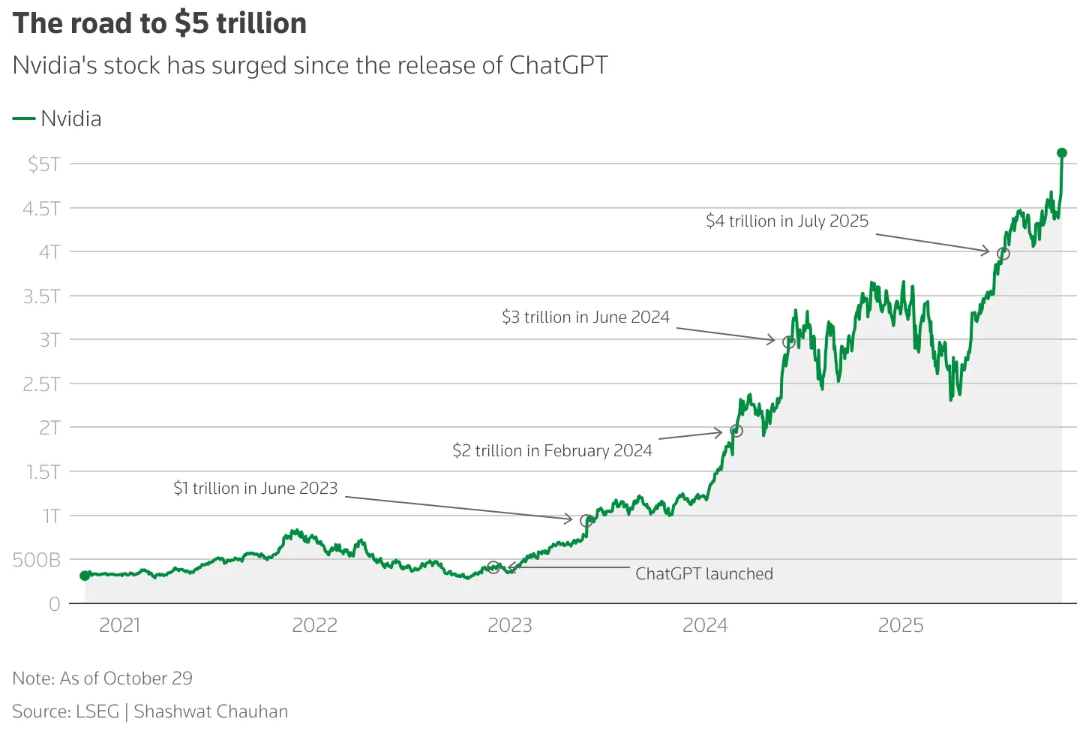

Nvidia made history as the first company to reach a market value of $5 trillion, turning CEO Jensen Huang into a Silicon Valley icon. However, where there is growth, there is doubt, and Nvidia’s meteoric rise, though dazzling, could also be the warning signs of a greater shift in economies, nations, and the global workforce.

Nvidia's rise to fame

Before the launch of OpenAI’s ChatGPT in 2022, Nvidia was predominantly known for the evolution of visual computing. Its business focus looked quite different from the AI-driven dominance it has today. For much of its history, Nvidia’s revenue came mainly from gaming and graphics hardware, especially its GeForce GPU line, which powered everything from personal gaming PCs to professional visualization workstations.

The company’s GPUs became the gold standard for rendering complex 3D graphics and visual effects, making Nvidia synonymous with high-performance gaming and computer graphics.

Alongside gaming, Nvidia built a strong enterprise and data center business starting in the mid-2010s, after its 2006 release of CUDA transformed GPUs into tools for general-purpose computing.

The company’s expertise in GPUs enabled it to become the driving force when it was discovered that its processors were ideal for handling the massive parallel computations needed for deep learning. With the rise of OpenAI and AI research, the company was catapulted into public awareness. Its GPUs now power nearly every major deep learning model.

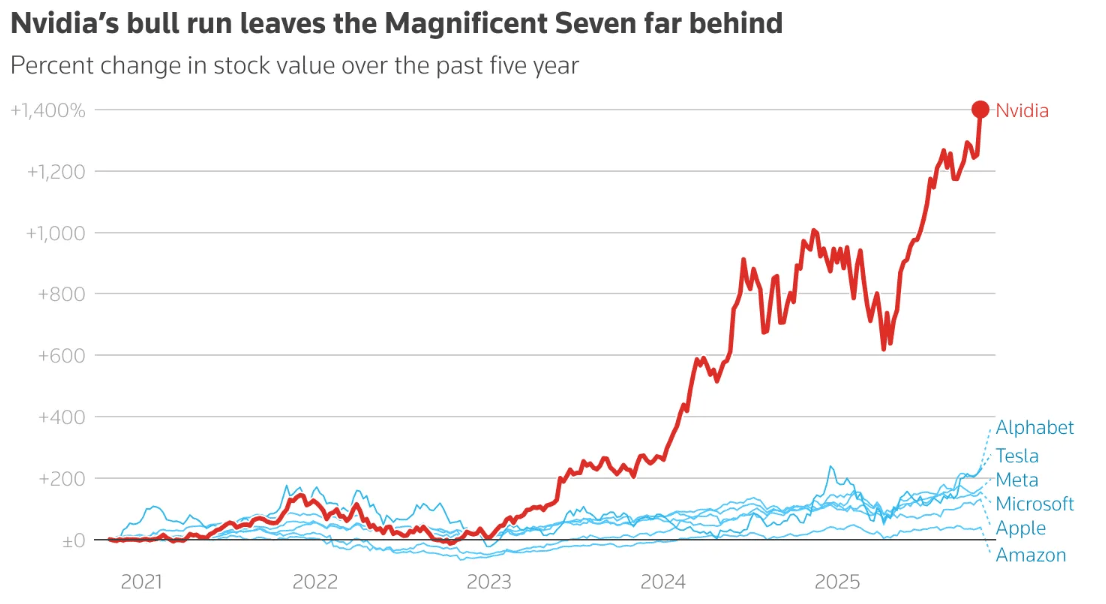

The rapid rise of Nvidia can be understood by looking at its share prices, which climbed 12-fold between 2022 and October 2025, a hard-to-replicate feat.

The trillion-dollar jump

A major driving force behind Nvidia’s rising market valuation is the massive amounts being spent to build up AI infrastructure, most of which runs on the company’s GPUs.

The company’s market valuation first touched $1 trillion in June 2023 and tripled in about a year, faster than Apple and Microsoft, the only other U.S. firms with market values above $3 trillion.

In 2023, the company reportedly contributed 7.3% of the S&P 500. With Apple and Microsoft accounting for around 7% and 6%, respectively.

By July 2025, Nvidia’s market valuation briefly touched $4 trillion. At the time, reports noted that strong Wall Street confidence in the rapid growth of AI was the driving factor behind valuation. Robert Pavlik, senior portfolio manager at Dakota Wealth in New York, told Reuters that Nvidia’s valuation “highlights the fact that companies are shifting their asset spend in the direction of AI, and it's pretty much the future of technology”.

However, investor sentiment did not rest solely on the company’s ability to make high-end AI chips, but also on its ability to ensure continued dominance and expansion of markets around the world.

Nvidia’s chief executive, Jensen Huang, has advocated for what he calls “sovereign AI”, the idea that each country should control the AI models its citizens use. This serves two purposes for Nvidia: it helps extend demand for its specialized chips globally, and it positions the company to do business with any nation, regardless of political leanings.

The demand for GPUs is such that the company has also become a bargaining chip for geopolitics around the global AI race, acting as a negotiator between the U.S. and China. The company is looking to get the U.S. to ease restrictions on high-end AI chips. At the same time, it is looking to ensure that it can continue to sell its chips in China, which in turn will ensure it can lock enterprises in its ecosystem before competition catches up.

To continue catering to the Chinese market, the company, along with AMD, agreed to give the US government 15% of its revenue from advanced chips sold to China in return for export licenses to the key market. It even designed less powerful chips that adhered to export restriction standards to be supplied to the Chinese market.

Despite the setbacks and the back and forth over its ability to cater to the Chinese market, Nvidia has continued to increase its grasp on the AI chip market. It presently accounts for nearly 90% of the global market for AI chips.

However, Nvidia’s success and its current valuation have raised questions around AI, its current promises of increased productivity and returns.

How real is Nvidia’s $5 trillion glow?

Skeptics warn that Nvidia’s rise to $5 trillion is emblematic of a trend that represents both a technology play and a macro bet on the AI economy itself. An industry expected to add trillions in productivity gains over the next decade. But these expectations hinge on continued exponential growth in AI adoption, data center spending, and enterprise deployment. These, some suggest, are akin to speculative excess.

Leading tech investors warn that soaring valuations may signal an AI stock market bubble that could culminate in a burst like the one witnessed with the dot-com bubble.

According to a report from The Guardian, James Anderson, an early backer of Tesla, Amazon, and China’s Tencent and Alibaba, raised concerns about Nvidia’s investment of up to $100 billion in OpenAI.

Under this deal, Nvidia said it would start delivering chips to OpenAI under two separate but intertwined transactions. While OpenAI will pay Nvidia in cash for chips, Nvidia will invest in OpenAI for non-controlling shares.

The deal and the subsequent rise in Nvidia's market value have created a market dynamic where the supplier is worth more than the ecosystem it serves. Some analysts call this an imbalance driven by investor psychology rather than sustainable fundamentals.

Others argue that while AI’s transformative potential is real, its monetization remains uneven across industries. Many enterprises still struggle to turn AI prototypes into scalable, revenue-generating applications, a lag that could undermine the sky-high expectations baked into valuations.

Academics describe this gap as a “Capability Realization Rate” or the difference between projected and realized AI value. Some studies suggest that markets may be overestimating how quickly AI systems will translate into measurable productivity. If adoption slows or margins compress, Nvidia’s valuation could contract sharply.

Despite the warnings, Nvidia’s leadership dismisses the idea of an AI bubble. CEO Jensen Huang argues that this phase represents a new industrial revolution powered by computation, not speculation. In his view, AI infrastructure is becoming the backbone of the next economy. As such, he compares the investment in AI infrastructure to the build-out of electricity or the internet: costly, necessary, and ultimately transformative.

Quick Bits, No Fluff

Microsoft’s AI chief says chasing machine consciousness is a “gigantic waste of time” and distracts from real progress in AI.

Studio Ghibli joins Japanese publishers urging OpenAI to stop using their creative works for model training.

Jeff Bezos added $10B in a day after Amazon’s OpenAI cloud deal boosted investor confidence.

Brain Snack (for Builders)

| Don’t confuse infrastructure with inevitability.Nvidia might power the current AI boom, but no moat lasts forever. If you’re building on today’s infrastructure, stay nimble. Vendor lock-in, pricing volatility, and shifting geopolitical winds can shake even trillion-dollar foundations. Your tech stack should serve your product, not define its future. |

Visa costs are up. Growth can’t wait.

Now, new H-1B petitions come with a $100k price tag. That’s pushing enterprises to rethink how they hire.

The H-1B Talent Crunch report explores how U.S. companies are turning to Latin America for elite tech talent—AI, data, and engineering pros ready to work in sync with your HQ.

Discover the future of hiring beyond borders.

*This is sponsored content

Wednesday Poll

🗳️ Which AI player will dominate 2026’s infrastructure race? |

Meme Of The Day

Rate This Edition

What did you think of today's email? |