- Roko's Basilisk

- Posts

- Beijing’s Nvidia Refusal

Beijing’s Nvidia Refusal

Plus: AI pins at work, Gemini on TV, and messy public-sector bots.

Here’s what’s on our plate today:

🧪 The Laboratory: Why Beijing is saying no to Nvidia.

🧠 Quick Bits: AI pins, court chatbots, Gemini TV.

🎯 Poll: Should chip tracking be mandatory on export GPUs?

🛠️ Brain Snack: Build models that can swap vendors.

Let’s dive in. No floaties needed…

Save $80,000 per year on every engineering hire.

Why limit your hiring to local talent? Athyna gives you access to top-tier LATAM professionals who bring tech, data, and product expertise to your team—at a fraction of U.S. costs.

Our AI-powered hiring process ensures quality matches, fast onboarding, and big savings. We handle recruitment, compliance, and HR logistics so you can focus on growth. Hire smarter, scale faster today.

*This is sponsored content

The Laboratory

Why is Beijing saying no to Nvidia chips?

The value of some commodities lasts only as long as their production is controlled. Look at diamonds: it is estimated that if their supply is not restricted, or if lab-grown diamonds are not carefully marked, then their value would be lowered substantially.

While artificial intelligence chips from companies like Nvidia and AMD are nothing like diamonds, their economics, at least, in 2025, are similar to them.

Washington blinks

The entire value of Nvidia as a company and its chips rests on their ability to run AI models. If another chip from a different company can outdo their performance, then there will be a substantial drop in their value.

Until December 2025, the U.S. had been working to ensure its technological superiority by restricting China’s access to Nvidia’s latest AI chips. However, towards the end of the year, things seem to be changing.

On 8 December, U.S. President Donald Trump announced that Nvidia could sell its powerful H200 chips to China. This relaxation of export controls was contingent on Nvidia giving 25% of the revenue from the sale of these chips to the U.S. government.

Just hours later, White House AI czar David Sacks delivered a different verdict. "They're rejecting our chips," he told Bloomberg. "I think the reason for that is they want semiconductor independence."

This was a dramatic shift for China, which for years had been working on accessing Nvidia chips to power its own AI ambitions. However, a closer look reveals that this shift is more strategic than dramatic.

Beijing’s strategic rejection

Beijing’s response has been less about cooperation and more about control. Rather than embracing Washington’s proposed guardrails, Chinese policymakers are turning the situation into leverage to push their own semiconductor ambitions forward.

Regulators are weighing rules that would limit how many Nvidia H200 chips Chinese companies can buy unless they also commit to purchasing domestic alternatives.

Firms seeking access to U.S. hardware may have to justify why local chips are not good enough, and in sensitive sectors like finance and energy, imported processors could be off-limits altogether.

The signal is unmistakable. Access to Nvidia will increasingly come with strings attached, and those strings are designed to pull companies toward Huawei and other local suppliers.

This is not just political theater. Many Chinese companies openly prefer Nvidia’s chips, not only for their performance but for the maturity of its CUDA software ecosystem, which still far outpaces Huawei’s CANN platform.

Tech giants like ByteDance and Alibaba have been eager to resume purchases as soon as restrictions allow.

Yet Beijing appears willing to accept short-term disruption if it speeds up long-term self-reliance. According to Bloomberg, China is preparing as much as $70 billion in new semiconductor subsidies, a move that could rank as the largest state-backed chip investment anywhere in the world.

However, for Beijing, it is not just about reducing dependence on the U.S.-based companies. It is also about protecting its own AI infrastructure.

Security, surveillance, and sovereignty

Recently, Nvidia revealed a new location verification technology. According to Reuters, Nvidia has built software that can estimate which country its chips are operating in by measuring communication latency with company servers. The stated purpose is fleet management and anti-smuggling compliance. Nvidia insists the system is read-only and contains no kill switch.

However, Chinese authorities are not convinced. In August, China’s cyberspace regulator summoned Nvidia to answer questions about what it called potential “backdoor safety risks” in its chips.

Around the same time, state media ran pointed scenarios describing how compromised hardware could bring critical systems to a halt, from power grids to transportation networks.

Against that backdrop, the timing of Nvidia’s tracking announcement is unlikely to ease Beijing’s concerns. Coming just days before the Trump administration approved exports of the H200 chip, the move risks reinforcing long-standing fears about reliance on foreign technology.

Even if China ultimately allows H200 imports, the prospect of building national AI infrastructure on hardware that communicates with servers run by an American company is deeply uncomfortable for officials already anxious about sovereignty, control, and strategic dependence.

To counter this shortage, China has also been working on domestic alternatives.

Building around the shortage

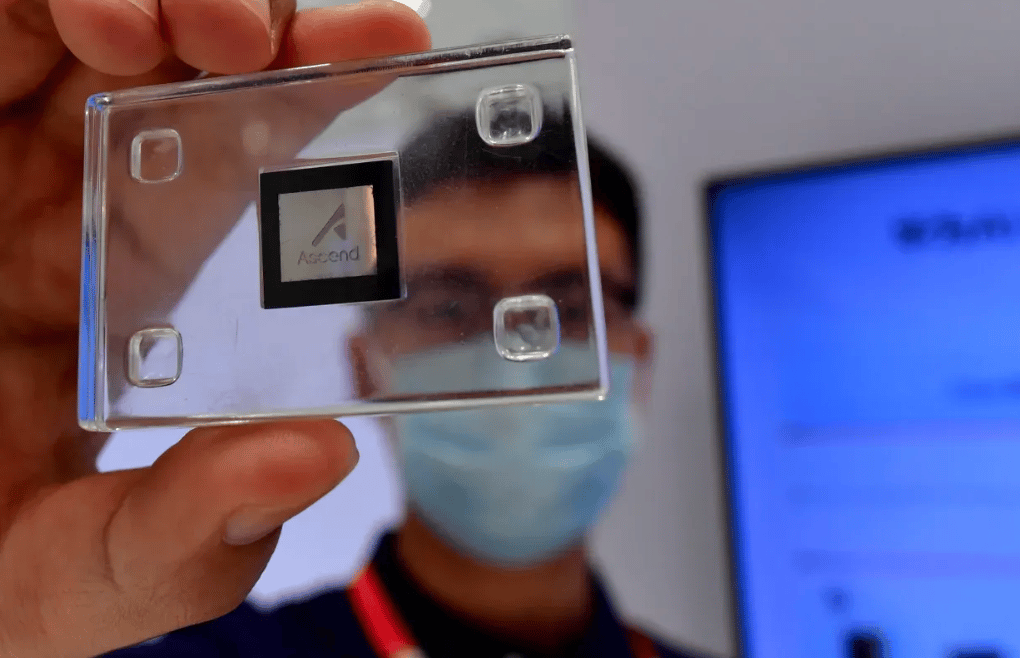

On paper, Nvidia still holds the performance edge. According to the Institute for Progress, Huawei’s Ascend 910C delivers about three-quarters of the raw processing power of Nvidia’s H200. Look at a single chip, and the gap is obvious.

But the picture changes once systems are built at scale. Huawei’s CloudMatrix 384 rack links 384 Ascend chips using high-bandwidth optical connections, allowing the system to deliver around 300 petaflops of dense BF16 compute.

That is nearly twice the output of Nvidia’s GB200 NVL72 system. The tradeoff is efficiency. Huawei’s approach consumes more power and requires more hardware to reach that level of performance.

For organizations that care most about independence rather than peak efficiency, those compromises are increasingly acceptable. The ability to avoid reliance on U.S. suppliers can outweigh higher operating costs, especially for state-backed firms and sensitive industries.

Huawei is also betting that time is on its side. Its roadmap points to the Ascend 960, expected by late 2027, with performance on par with today’s H200. If that timeline holds, the current performance gap may soon matter far less than questions of control, resilience, and strategic autonomy.

So, while the U.S. is willing to ease up on export restrictions, China wants to ensure it can reduce its reliance on Nvidia chips while building up its own abilities. In the meantime, for the global technology workforce, this standoff carries several implications.

From chip war to chip market

First, expect more policy whiplash. Decisions like Trump’s approval of the H200 could still be overturned by Congress, blocked by Chinese regulators, or rewritten by a future administration.

The White House’s deal-making may not survive Capitol Hill. Just days before Trump approved exports of Nvidia’s H200, a bipartisan group of senators introduced the SAFE Chips Act, which would lock in tougher export limits through 2028 and strip the administration of flexibility.

The bill reflects a broader unease in Washington, across party lines, with treating AI chips as bargaining chips rather than national security assets.

For companies trying to build long-term AI strategies, that uncertainty is becoming the norm. Betting too heavily on access to either American or Chinese hardware now carries real risk.

Second, the split between AI ecosystems is deepening. Nvidia’s CUDA platform still dominates globally, but inside China, developers are increasingly adapting to domestic alternatives.

Over time, this divergence could make it harder to move AI models, workloads, and even talent across borders, reinforcing a technological divide that mirrors the political one.

Third, the chip war is starting to resemble a marketplace rather than a standoff. The idea of revenue sharing and conditional access suggests future export controls may look less like outright bans and more like shifting licensing deals, where terms change with diplomatic moods and strategic priorities.

For Nvidia, the H200 announcement was meant to signal a reopening of China’s massive AI market. Instead, it has become a reminder that flexibility cuts both ways. What Washington offers, Beijing can decline. And in that back-and-forth, chips are no longer just products, but bargaining tools.

Much like diamonds, while the U.S. may have succeeded in controlling the price. It seems like China is working hard to break away from the market and rely on its lab-grown carbon jewels rather than let the West control all the strings of the market.

Brain Snack (for Builders)

| If your AI stack assumes “Nvidia forever,” you’re doing architecture, not strategy. Build for multi-vendor, multi-jurisdiction GPUs now, or let geopolitics refactor your infra for you. |

The context to prepare for tomorrow, today.

Memorandum merges global headlines, expert commentary, and startup innovations into a single, time-saving digest built for forward-thinking professionals.

Rather than sifting through an endless feed, you get curated content that captures the pulse of the tech world—from Silicon Valley to emerging international hubs. Track upcoming trends, significant funding rounds, and high-level shifts across key sectors, all in one place.

Keep your finger on tomorrow’s possibilities with Memorandum’s concise, impactful coverage.

*This is sponsored content

Quick Bits, No Fluff

Plaud’s new AI pin and desk hub: a wearable mic plus desktop notetaker aiming to kill “manual meeting minutes” for good.

Alaska’s court system rolled out an AI chatbot for self-help legal questions, then yanked it after wrong answers and bias concerns piled up.

Gemini is coming to Google TV with Nano Banana and Veo, letting you generate AI videos, images, and on-the-fly settings tweaks directly on your TV.

Wednesday Poll

🗳️ Who’s actually playing this H200 “win” better? |

Meme of the Day

Rate This Edition

What did you think of today's email? |