- Roko's Basilisk

- Posts

- Inside AI’s Two-Sided Economy

Inside AI’s Two-Sided Economy

Plus: India heats up, Trump centralizes rules, and parents debate bans.

Here’s what’s on our plate today:

🧪 AI’s two-sided economy: infra boom, application struggles, bubble fears.

🧠 Amazon India bets, Trump AI rulebook, Australia’s teen ban.

🧩 Roko’s Pro Tip: stop LARPing as Nvidia, be a buyer.

🧮 Poll: AI bubble or groundwork, builder or buyer mindset.

Let’s dive in. No floaties needed…

Outperform the competition.

Business is hard. And sometimes you don’t really have the necessary tools to be great in your job. Well, Open Source CEO is here to change that.

Tools & resources, ranging from playbooks, databases, courses, and more.

Deep dives on famous visionary leaders.

Interviews with entrepreneurs and playbook breakdowns.

Are you ready to see what’s all about?

*This is sponsored content

The Laboratory

The state of AI in 2025: the two sides of the AI economy

When Henry Ford revolutionized the automotive industry through the assembly line, not many would have been able to imagine how it would change factories for a long time to come.

What Ford did helped transform a luxury product into something that reshaped daily life for millions. His story is a reminder that new technologies often begin as expensive and niche, and only become transformative when their reach expands and businesses learn how to use them.

Ford’s innovation mattered not because of the machine itself but because he created the system that made it useful. AI in 2025 faced that same challenge: extraordinary engines, but no assembly line for turning capability into widespread impact.

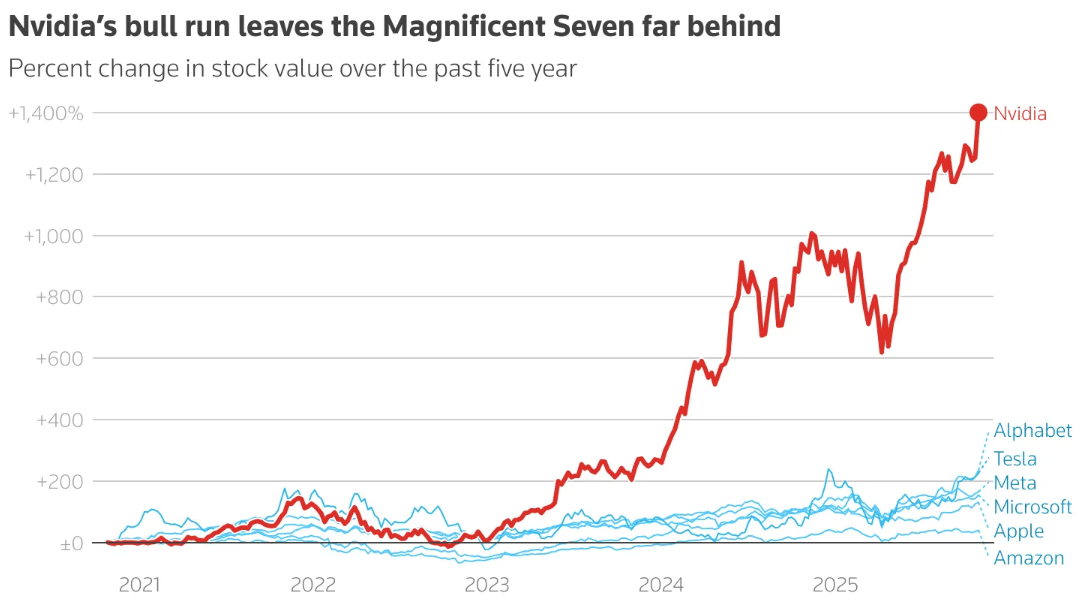

For AI, 2025 was a year that will be remembered for its dramatic bifurcation. On one hand, infrastructure providers like Nvidia reached unprecedented valuations, while on the other hand, many AI application companies struggled to demonstrate sustainable business models.

The year also intensified debates about an AI bubble, as massive capital expenditures by tech giants approached $200B annually while revenue generation from AI products remained uncertain.

Traditional enterprises, meanwhile, found it difficult to move from AI trials to full deployment, widening the gap between firms that build AI and those that buy it. That split surfaced bigger questions about who will capture value, what infrastructure will be required, and how long AI’s economic impact will really take.

The year then appeared to be a tussle between investing in the underlying infrastructure of a technology and finding real return on the investment.

The capital expenditure surge

AI infrastructure spending reached a scale in 2025 that the tech industry had never seen before.

Microsoft, Meta, Google, and Amazon together planned more than 190 billion dollars in capital spending, most of it dedicated to data centers and AI hardware.

This was more than a 50% jump from 2024, and the pace continued to accelerate through the end of the year.

Nvidia became the clear winner in this wave of investment. Its valuation climbed past $5 trillion in 2024 and continued to rise through 2025 as companies rushed to buy the H100 and newer H200 chips. Nvidia’s data center revenue rose 427% year-over-year in early 2024, and similar growth patterns held throughout 2025.

While the big tech giants spent handsomely on the underlying infrastructure and some even saw soaring valuations. On the application side, things were not so buoyant.

The application layer struggles

Infrastructure companies thrived, but many AI application companies faced a far tougher reality. OpenAI projected a $5B loss for 2024, even at a $150B valuation, as high compute costs outpaced revenue. Startups struggled even more.

McKinsey found widespread AI adoption but limited deep integration or clear financial returns. It also found that AI is often used function-by-function, not yet baked into full business operations. Those who succeed tend to treat AI as a strategic, enterprise-wide transformation rather than a one-off experiment.

Venture capital investors remained active but began demanding clearer business paths and reduced burn rates.

Infrastructure economics

The growth of Nvidia also reflected deeper economics. Its AI chips carried gross margins above 75%, far higher than competitors.

AMD generated 4.5 billion dollars in AI chip revenue in 2024, but the figure remained small compared with Nvidia’s more than $100B business.

Cloud platforms used this hardware wave to fuel new AI services. Microsoft said AI contributed six percent to Azure’s growth by mid-2024. Yet even cloud providers struggled with the economics, as AWS alone expected to spend 75 billion dollars on capital expenditures in 2024.

The bubble debate

The massive investments and the lack of returns in deployment were interpreted in two main ways.

On one hand, some argued that these massive investments were akin to a bubble. On the other hand, Nvidia CEO Jensen Huang said the massive investments were akin to investment in infrastructure for the deployment of electricity and other similar critical infrastructure.

The bubble argument pointed to clear risks. Sequoia estimated that AI companies would need to produce 600 billion dollars in annual revenue to justify current infrastructure spending. Actual AI-specific revenue in 2025 was somewhere between 50 and 100 billion dollars. Some analysts compared the trend to the dot-com era, calling it investment ahead of business validation.

Others argued the comparison was unfair. Cloud providers already had strong revenue streams, and AI demand was limited only by supply.

Satya Nadella said companies wanted more AI infrastructure than Microsoft could provide. Huang, meanwhile, said this was a once-in-a-generation shift in computing, similar to the rise of personal computers and smartphones.

The spending surge sparked a deeper question that defined 2025: was this investment laying the foundation of a new technological era or inflating a bubble that revenues could not justify?

While this debate captured media attention, another question was being asked. Who would capture the real profits from AI deployment?

The revenue recognition challenge

A major open question became which companies would capture the economic value of AI. Foundation model companies faced high costs and uncertain margins.

ChatGPT reached 200 million weekly users in 2024, yet OpenAI struggled to generate sustainable revenue. Anthropic raised more than 7 billion dollars during 2024 but continued to spend heavily on compute.

Traditional enterprise software companies often had better results. Salesforce reported $1B in Einstein AI revenue in 2024. Microsoft said its Copilot products reached 70 million commercial users and generated strong incremental revenue. Still, enterprises questioned which tools created real value.

This made the divide between companies that build AI and companies that buy AI even more stark in 2025.

Builders operated like growth-stage tech companies, spending aggressively to scale. Buyers, on the other hand, wanted clear business cases and predictable returns.

Deloitte reported that despite spending millions on AI initiatives, enterprises struggled to show a measurable impact. Many companies faced challenges like poor data quality, limited AI engineering talent, and resistance to changing business processes.

MIT found that with current technology and costs, only about 23% of wages tied to vision-based work make financial sense to automate. In practical terms, most U.S. companies would choose not to automate the majority of tasks that AI could handle, simply because it would not be cost.

All these factors made 2025 a turbulent year for the business side of AI. On one hand, companies spent billions on building critical infrastructure for the technology. Researchers found that the true impact of the technology was yet to be realized.

In this scenario, the AI market settled into three layers. Foundation models remained dominated by OpenAI, Anthropic, Google DeepMind, and Meta, while Chinese players such as DeepSeek and Alibaba’s Qwen gained momentum.

Nvidia maintained leadership in infrastructure, although shorter wait times for GPUs raised concerns about possible overcapacity.

The application layer remained the most uncertain. Many products struggled to stand out from simple model wrappers that users could easily replicate.

Beyond 2025

As 2025 comes to a close, the situation for AI technology looks akin to what the automotive industry would have been before Henry Ford came along and changed everything.

Just as the assembly line turned automobiles from luxury to necessity, the next breakthrough in AI may not be a model at all but the system that finally turns intelligence into impact.

Since that remains to be seen, during the year, the question of the AI bubble made many rethink their positions, while others doubled down on theirs.

Roko Pro Tip

| 💡 List your top three AI bets for 2026. For each, ask: “Are we a builder or a buyer here?” If you can’t clearly justify why you’re acting like an infra company instead of just renting GPUs to fix your own P&L, kill or shrink that bet. |

Hire smarter teams—not bigger budgets.

Athyna helps you build high-performing teams fast—without overspending.

Our AI-powered platform matches you with top LATAM talent tailored to your needs in just 5 days.

Hire pre-vetted professionals ready to deliver from day one and save up to 70% on salaries.

Scale smarter, faster, and more affordably with Athyna.

*This is sponsored content

Monday Poll

🗳️ Given 2025’s AI spending binge, which description fits your view best? |

Bite-Sized Brains

Amazon doubles down on India’s AI future: It’s planning over $35B in India by 2030 for AI, logistics, and exports, aiming for 1M new jobs.

Trump pushes a single AI rulebook: A coming “One Rule” executive order would federalize AI regulation, so states can’t run their own playbooks.

Parents split over Australia’s under-16 social ban: New interactive shows many like the idea in theory, but plan to bend or selectively ignore the rules in practice.

Meme Of The Day

Rate This Edition

What did you think of today's email? |