- Roko's Basilisk

- Posts

- When SaaS Pricing Breaks

When SaaS Pricing Breaks

Plus: Flock surveillance, Google Glass’s legacy, and frontier AI burn.

Here’s what’s on our plate today:

🧪 How AI is breaking SaaS pricing, and who survives it.

🧠 Bite-Sized Brains: Flock surveillance, Google Glass, frontier AI burn.

📊 Poll: Seat, usage, outcome, or hybrid AI pricing?

🧮 Roko’s Pro Tip: stress-test your future AI bills.

Let’s dive in. No floaties needed…

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

*This is sponsored content

The Laboratory

How AI is changing the pricing structure of software

Every major technological advancement forces businesses to re-evaluate their value proposition and make sure their product not only fulfills a supply gap but also provides adequate profits to fuel future growth.

Take the example of Amazon. It began as an online bookstore, expanded into a global ecommerce platform, and eventually became a cloud computing giant. This evolution shows how a company can adapt when profit margins tighten and technology shifts.

Retail offered thin margins and intense competition, so Amazon built AWS, which became its main profit engine and helped the company scale. Today, Amazon is the world’s largest cloud provider and one of the most valuable companies on the planet.

Similarly, when Netflix was first launched, its business model was to rent DVDs through the mail. But as broadband adoption grew and streaming threatened the viability of physical media, the company chose to disrupt itself rather than defend its original business. It steadily shifted away from DVDs, invested in original programming, global content, and data-driven recommendations to keep users engaged.

By adapting early and embracing new technologies, both companies managed to stay relevant and build businesses that helped shape their respective industries.

AI becomes the new disruptor

In 2025, Artificial Intelligence (AI) has become the disruptor, and SaaS companies are scrambling to adapt to the new realities. One of the major challenges for SaaS companies is how to price products that make use of AI models to ensure sustainable growth.

At the same time, enterprises are grappling with the question of how to align their budgets for a change that shows no sign of slowing down.

Why AI is reshaping software pricing

Unlike traditional SaaS, where pricing is predictable, AI costs money every time it runs, which means expenses fluctuate with usage. This is pushing providers to rethink their pricing strategies and leaving many enterprises unsure of what to expect.

Instead of paying a fixed per-seat subscription, companies are now shifting toward pay-as-you-go models that function more like utility bills. Costs are tied to how many requests they make, how much compute they use, and how often they rely on advanced models.

This is very different from the SaaS model, where subscription prices stay fixed and only increase as more users are added. With AI, monthly bills can swing up or down based on usage, making budgeting harder and adding pressure on procurement teams. At the same time, vendors are experimenting with new pricing structures to cover their own rising infrastructure costs, creating a fast-moving environment that many enterprises are still struggling to navigate.

AI providers are also unsure of how to tackle the problem. According to research from Andreessen Horowitz, nearly three out of four AI companies are testing different pricing models, and many try several in their first year.

The reason is clear. Companies that stick to old per-seat pricing for AI tools tend to make less money and lose more customers than those that charge based on usage or outcomes.

Just over the past year, seat-based pricing has dropped while hybrid pricing has grown quickly. All of this means enterprises are entering a new pricing era where costs can rise and fall with usage, traditional negotiation power is fading, and pricing strategy is becoming a deciding factor in who wins and who loses.

Why AI costs more than traditional SaaS products

Traditional SaaS products are expensive to build but cheap to run because the cost of serving one more user is basically zero.

AI tools, however, are different. Every prompt, every API call, and every model query carries a real infrastructure cost.

GitHub Copilot is a good example. At launch, it charged users 10 dollars a month but spent about $30 per user to run the service. Heavy users cost as much as $80 a month in computing alone.

These economics explain why AI companies often operate with lower gross margins compared with what classic SaaS businesses enjoy. It also explains why most AI startups say infrastructure costs are their biggest barrier to growth. When each customer interaction has a real price tag, the old SaaS pricing playbook simply stops working.

For enterprises, this creates major challenges. For decades, they negotiated predictable software contracts with fixed seat counts and stable annual costs.

AI breaks that model. Cloud and AI spending now fluctuates based on usage, and companies are struggling to plan for it. According to Flexera, more than 80% of enterprises rank cloud spend management as their top challenge, and most regularly blow past their budgets. Some companies have seen their AI bills spike from $2,000 to $18,000 in a single month because of seasonal demand.

As such, what used to be a simple buying decision now requires audits, modeling, and constant back-and-forth across departments.

AI has not only changed how software companies make money. It has changed how enterprises buy software in the first place.

The new pricing models

To keep up with this rapid shift, software companies are experimenting with new pricing models that better reflect how AI is actually used. Many are moving toward usage-based or outcome-based pricing that ties cost directly to the value delivered.

Currently, there are three prevalent pricing models that are competing for dominance. These include usage-based pricing, outcome-based pricing, and a hybrid that combines the two.

Usage-based pricing, where customers are charged based on what they actually use, such as API calls, tokens, or compute time. OpenAI, for example, charges per 1,000 tokens. It is fair and easy to start with, but it can make budgets unpredictable and hard for enterprises to forecast.

The second is outcome-based pricing. Here, customers pay only when the AI delivers a successful result. Intercom charges per resolved conversation, and Riskified charges only for fraud-free transactions. It builds trust and aligns cost with value, but it can be difficult to measure outcomes and creates revenue uncertainty for vendors.

And finally, there is the hybrid pricing model. Under this, the base subscription is mixed with usage or outcome fees. Microsoft’s Copilot charges a monthly fee per user and then adds extra charges for premium model usage. It offers a balance of predictability and upside potential, but it can be harder for buyers to understand and manage.

How enterprises are responding

Enterprises are changing how they buy AI tools because the costs are harder to predict. Many are putting new rules in place to control spending, such as setting limits on usage and asking vendors to show clearer cost estimates upfront.

Some are forming teams that include finance, engineering, and procurement to track AI expenses as they happen. But even with these steps, most companies say they are still figuring out how to handle the ups and downs of AI pricing.

According to data from Gartner, in 2025, 59% of CFOs said they were using AI in their finance teams, which is almost identical to the year before, even though most of them say they feel more optimistic about the technology. The message is clear. Leaders are excited about AI, but many still do not know how to budget for it or measure whether it is delivering real returns.

The disconnect continues in spending plans. Nearly eight in 10 CFOs expect to increase their AI budgets this year, yet most are not actually using generative AI in their finance operations. Much of this hesitation comes from complicated procurement processes, unpredictable usage-based costs, and the difficulty of proving ROI when expenses fluctuate month to month.

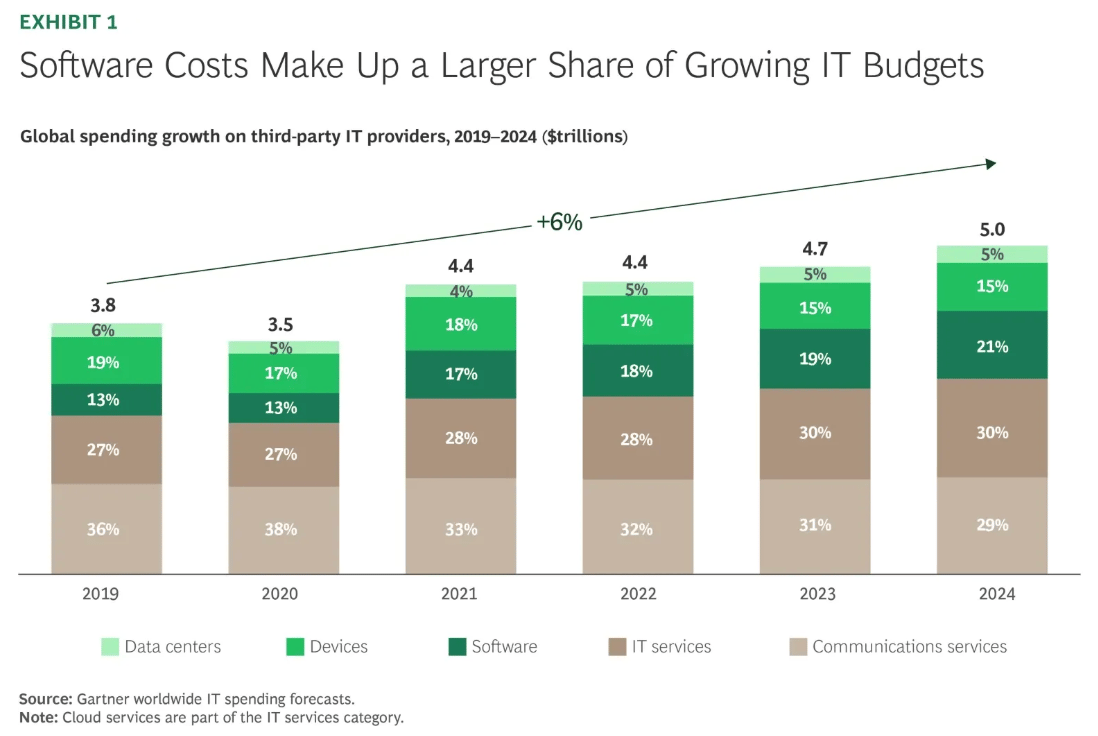

According to BCG’s research, overall tech spending is rising about 6% a year, but software spending is growing even faster.

Between 2019 and 2024, software costs jumped from 13% to 21% of total IT budgets. The old negotiation playbook, locking in flat rates, signing multi-year deals, or asking for volume discounts, no longer works when vendors move to consumption-based pricing.

The road ahead

The disruption caused by technological advances can be confusing and overwhelming for enterprises that sit on the fence until they are forced to change course. However, with AI, the disruption is so rapid that even agile organizations are having a hard time adjusting to the changes.

However, if pattern recognition is anything to go by, then the period of turmoil will reveal the coming crop of Netflix and Amazon. Companies that are agile and quick to adjust to the changing tides.

Roko Pro Tip

| 💡 Take one AI tool you use today and model 3 scenarios: current usage, 3x usage, and 10x usage under its pricing plan. If the 10x scenario would get you yelled at by your CFO, you’re not buying software, you’re buying a future budget crisis. |

Powered by the next-generation CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

*This is sponsored content

Bite-Sized Brains

Flock offshores your license plate: Leak shows Flock’s US surveillance cameras use Filipino gig workers to review and label footage.

Google Glass gets a postmortem: Version History unpacks how Glass went from moonshot to “Glassholes” and shaped today’s smart glasses.

VC calls Frontier AI burn “ludicrous”: Mitchell Green tells CNBC that OpenAI and Anthropic’s cash burn looks wildly unsustainable.

Monday Poll

🗳️ If you had to pick one dominant pricing model for your company’s AI tools, which would you choose? |

Meme Of The Day

Rate This Edition

What did you think of today's email? |