- Roko's Basilisk

- Posts

- When Carmakers Pretend They’re SaaS

When Carmakers Pretend They’re SaaS

Plus: Agentic browsers stall, RAM prices spike, and social media trashes kids’ focus.

Here’s what’s on our plate today:

🧪 Why legacy automakers are stumbling through the AI shift.

🧠 Quick Bits: AI browsers, RAM crunch, social media focus damage.

📊 Poll: factory AI, in-car features, partnerships, or slow-roll?

🛠️ Three things to stop your AI roadmap from becoming Cariad 2.0.

Let’s dive in. No floaties needed…

Visa costs are up. Growth can’t wait.

Now, new H-1B petitions come with a $100k price tag.

That’s pushing enterprises to rethink how they hire.

The H-1B Talent Crunch report explores how U.S. companies are turning to Latin America for elite tech talent—AI, data, and engineering pros ready to work in sync with your HQ.

Discover the future of hiring beyond borders.

*This is sponsored content

The Laboratory

Why legacy automakers are struggling with AI

A fascinating way to assess what the future might look like for technology is to look at historical parallels. The motive for this assessment should not be to try and dissuade individuals from adopting new technologies. Rather, it is to ensure that the mistakes of the past are not repeated in the future.

In 2025, almost every sector of the economy will be impacted by the advent of artificial intelligence (AI). Making it important for enterprises to look at the past and adjust course to avoid the negative impact of a new technology.

Today, the businesses stand on the cusp of a change that could define the future of human economic endeavours. However, in this progression, some industries, or rather, some companies, may face a bleak future unless they can adapt to the changes.

The AI boom that fizzled

Recently, a study conducted by Gartner revealed a troubling trend in the automotive industry. According to the findings of the study, the current surge of AI investment across the auto industry may not last.

Today, almost every major carmaker is pouring money into AI, but by 2029, only about 5% are expected to sustain strong growth in this area.

The study further suggested that only companies with deep software capabilities, tech-focused leadership, and a long-term commitment to AI will stay competitive.

This is in stark contrast to the industry's AI ambitions that reached fever pitch between 2020 and 2024.

During this timeframe, nearly every major manufacturer announced ambitious programs to integrate AI across vehicle operations, from autonomous driving systems to predictive maintenance and personalized in-cabin experiences.

Legacy carmakers, including Volkswagen, even announced the creation of independent business units to focus on the software. The company announced the creation of Cariad in 2020 with plans to become "the second SAP," while traditional manufacturers poured billions into software divisions and AI talent acquisition.

The larger industry also reflected this optimism.

According to Grand View Research, the global market for automotive AI was valued at 4.29 billion dollars in 2024, with analysts predicting explosive growth to 14.92 billion dollars by 2030. Industry presentations painted a picture of sweeping transformation, and conference stages were filled with bold promises about the future.

However, the euphoria was short-lived as many companies struggled to deliver.

Volkswagen’s Cariad unit reported more than 7.5 billion dollars in operating losses between 2022 and 2024 while generating only 3.5 billion dollars in revenue. Software setbacks delayed the launches of the Porsche Macan Electric and the Audi Q6 E Tron by more than two years. Early versions of the VW ID.3 and ID.4 were released with widely criticized software issues. These problems were not isolated.

They reflected a broader challenge facing the entire sector.

The cycle of early enthusiasm followed by disappointing execution is speeding up. Investments that surged between 2020 and 2022 are now giving way to a period of consolidation, and Gartner expects this shift to be largely complete by 2029.

Gartner analyst Pedro Pacheco says the industry is caught in a kind of AI euphoria, where companies hope for big breakthroughs before they have the basics in place. It is a pattern seen across many sectors. An MIT study found that 95% of enterprise AI projects never make a real financial impact because most never move past the pilot stage.

This rise and fall of excitement is happening faster than before. The heavy investments made between 2020 and 2022 are now shifting toward more cautious planning, and Gartner expects this reset to be mostly finished by 2029.

Why legacy automakers fall behind

Driving this shift is not just the lack of big breakthroughs, but also fundamental problems and broader shifts in consumer behavior.

Legacy automakers are engineering companies trying to reinvent themselves as software organizations without the foundations needed to succeed.

Gartner notes that software and data form the core of effective AI, yet most traditional manufacturers lack mature capabilities in both. The Volkswagen Cariad example shows how deep the problem goes.

Former employees described unclear roles, redundant systems, and no unified architecture. These issues are rooted in decades of hardware-centric structures that do not translate well to modular software development or rapid iteration.

This gap creates a poor return on investment for vehicle software AI. Building AI models requires costly computing infrastructure, cloud capacity, and long development cycles. Automotive timelines stretch across several years, which means AI deployed today may not generate revenue until the next model cycle.

The tendency of AI pilots to struggle when it comes to generating a return on investment, as shown by the MIT study, impacts the automobile industry just as it does every other industry.

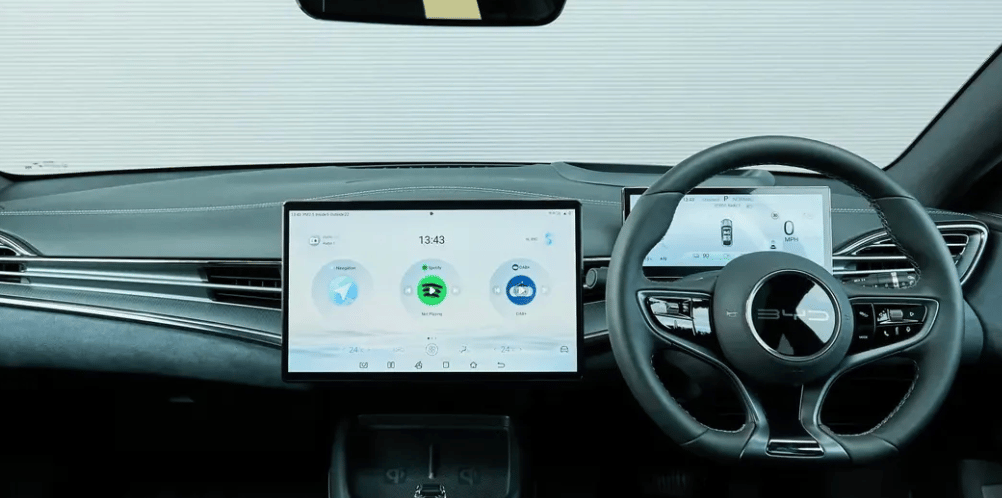

By contrast, AI investments in manufacturing provide clearer returns. Automation improves quality, lowers costs, and speeds production, allowing companies like BYD to document tangible gains.

For such software-native automakers, it is easier to pull ahead of legacy carmakers. As such, for many legacy automakers, the smarter financial strategy is to focus on factory AI rather than ambitious vehicle intelligence projects that demand major organizational change and offer uncertain payoff.

Rethinking investment strategies

However, not everyone in the industry agrees with the idea that the software pushed by legacy automakers should be abandoned.

Some industry experts argue that automotive AI investment needs to be viewed over a longer time horizon. Despite growing caution, analysts still project the global automotive AI market to grow 20 to 30 percent annually through 2030.

From this perspective, Gartner's forecast that only 5% of automakers will maintain strong AI investment may signal natural maturation rather than failure. Early AI spending is broad and experimental. As the technology matures, investment becomes more targeted, and consolidation among companies with strong foundations could lead to more effective deployment.

Dealership data also shows continued optimism. 95% believe AI will be critical to future success, and every dealership currently using AI reports revenue increases. This suggests demand remains strong even if manufacturers rethink their strategy.

In such a scenario, partnerships may provide a path forward. Volkswagen’s collaborations with Rivian and Xpeng reflect a shift toward buying capabilities rather than building everything internally.

Consumer interest also complicates the picture. Many drivers do not value vehicle AI enough to justify large investments, especially when phones provide similar features. The exception is China, where companies like BYD and Xpeng continue aggressive AI growth supported by strong demand and government backing, potentially reshaping global industry leadership.

A split future for the industry

As such, in the coming years, we may witness a much more bifurcated automotive market. On one hand, companies like BYD and Tesla will continue their software-first approach. While legacy automakers will face difficult choices.

Some will pursue partnership strategies, licensing software from the leaders, or forming joint ventures. Volkswagen's trajectory suggests this path, with Cariad repositioned as a coordinator rather than a developer. Others may exit certain segments entirely, focusing on markets or price points where AI capabilities matter less.

Whichever path the industry takes, it will take time for the true impact of AI to be seen in the automobile industry. If history is viewed as a teacher, one should remember that when automobiles were first introduced, horse-drawn carriages did not disappear overnight.

If we factor in the different stages and differing timelines around the world, then it would not be wrong to say that the transition took roughly one generation.

The transition to AI, then, is still in its infancy. Even if we look at it from the perspective of rapid advances in technology, it could be decades, if not more, before we can truly understand the impact of AI on the automotive industry.

Quick Bits, No Fluff

Agentic AI browsers hit reality: Automated AI browsers promise hands-free surfing, but clunky UX, security risks, and user habits mean Chrome still wins for now.

RAM shortage taxes your gadgets: An AI-fueled DRAM crunch is doubling prices and forcing PC, phone, and console makers to hike retail costs through 2027.

Social media is hammering kids’ focus: A large study links heavy social use in 10–14 year-olds to rising inattention and ADHD-like symptoms, unlike TV or video games.

The context to prepare for tomorrow, today.

Memorandum distills the day’s most pressing tech stories into one concise, easy-to-digest bulletin, empowering you to make swift, informed decisions in a rapidly shifting landscape.

Stay current, save time, and enjoy expert insights delivered straight to your inbox.

Streamline your daily routine with the knowledge that helps you maintain a competitive edge.

*This is sponsored content

Thursday Poll

🗳️ If you were running a legacy auto OEM with a limited AI budget, what would you prioritize? |

3 Things Worth Trying

Run a ‘factory vs features’ audit: List your current or planned AI projects, and tag each as factory (ops, infra, core systems) or features (front-end magic, demos, UX sprinkles). If most budget sits in ‘features’ with fuzzy ROI, you’re behaving like Cariad, not BYD.

Decide what you’ll never build yourself: Make a simple table of AI capabilities (models, data platform, orchestration, vertical apps) and mark each as Build / Buy / Partner. Anything marked Build without a clear moat, talent, or time advantage gets demoted—before it becomes your 7.5B loss line.

Extend your time horizon on one bet: Pick a single AI initiative where payoff will take years (not quarters), and write a one-page generation-length thesis: why it matters, what milestones prove it’s working, and which metrics justify killing it. Treat it like an EV platform, not a growth hack.

Meme Of The Day

Rate This Edition

What did you think of today's email? |